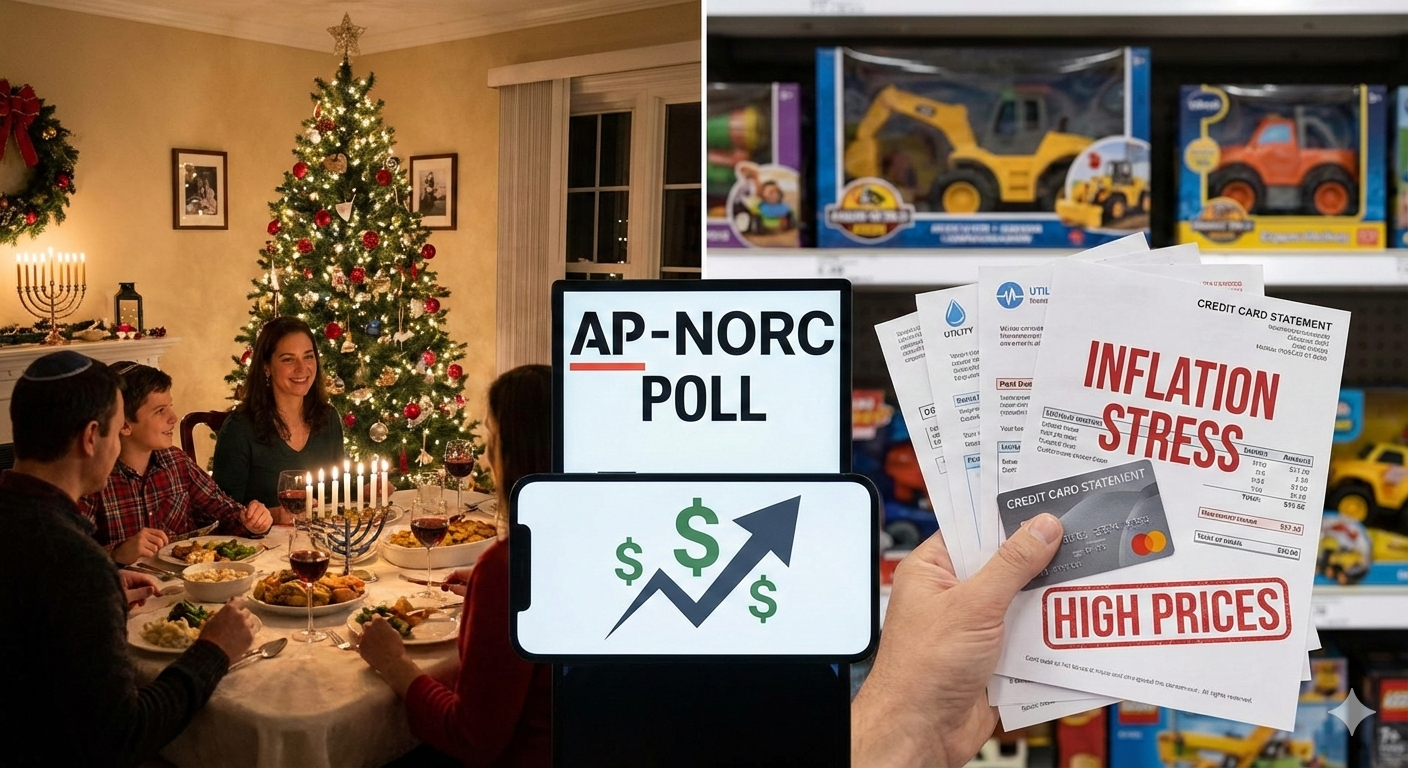

High Prices Cloud the Holidays as Americans Struggle Despite White House Economic Optimism

Rising grocery, electricity, and gift prices are straining U.S. families this holiday season, even as the White House highlights economic strength. Families are feeling the weight of increased costs, with many reporting that their holiday budgets are tighter than ever. Experts analyze the implications of these economic trends, tying them to the larger context of … Read more